How to Know Which Depreciation Method to Use

Divide by 12 to tell you the monthly depreciation for the asset. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

What Is Depreciation Types Examples Quiz Accounting Capital

Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

. The first cost of a machine is Php 1800000 with a salvage value of Php 300000 at the end of its six years of life. Want to know how to calculate depreciation rate using the straight-line method. Again not difficult just reference Appendix A of IRS Publication 946.

The tables themselves are remarkable easy to use. Simple you can use the following formula. Solve for the annual depreciation.

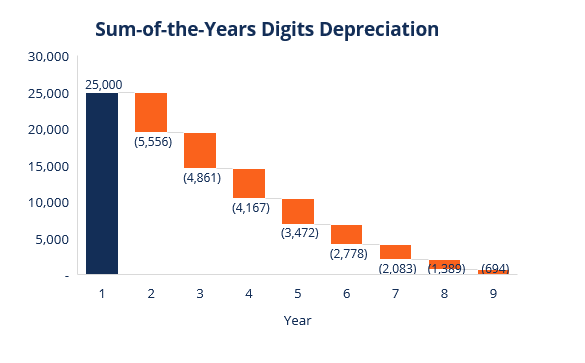

For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. 25000 - 50050000 x 5000 2450. 27 years This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the assets life.

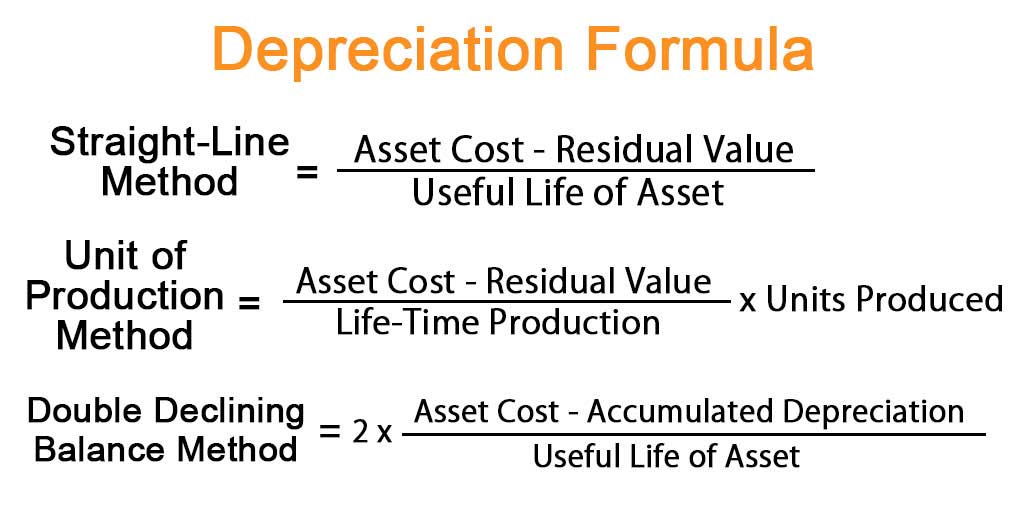

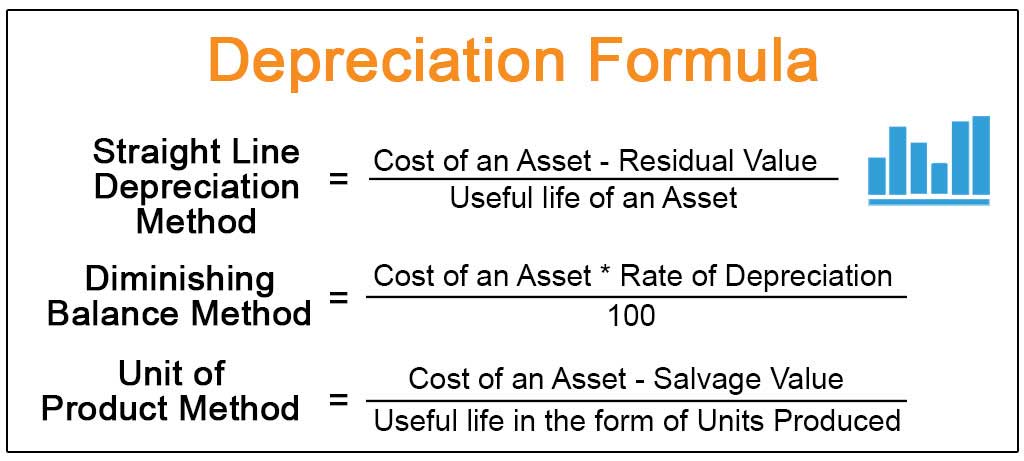

For allocating the cost of a capital asset Types of Assets Common types of assets include current non-current physical. Determine the total depreciation after three years using the Straight Line Method of Depreciation. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses.

You can calculate straight-line depreciation by subtracting the assets salvage value from the original purchase price and then dividing it by the total number. The depreciation amount is treated as an operating expense in the income statement whereas the asset is reported at its Net Book Value Cost Accumulated Depreciation in the balance sheet. All 3 assets will use Table A-1.

All 3 assets are considered to be nonfarm 5 and 7 year properties so we will use the GDS using 200 DB method. GDS using 150 DB. Asset cost - salvage valueestimated units over assets life x actual units made.

To use a home depreciation calculator correctly you must first identify three fundamental indicators. Plug in your system method recovery period convention and so forth and the chart will tell you which table to use from A-1 to A-20. Generally if you can depreciate intangible property you usually use the straight line method of depreciation.

In order to calculate the value the difference between the assets cost and the expected salvage value is. This is the most commonly used method for calculating depreciation. To determine the depreciation method to use refer to the Depreciation Methods table.

15-year and 20-year classes use 150 Declining Balance method GDS This depreciation method gives you a higher depreciation rate 150 more than the straight-line method. The propertys basis the duration of recovery and the method in which you will depreciate the asset. Divide this amount by the number of years in the assets useful lifespan.

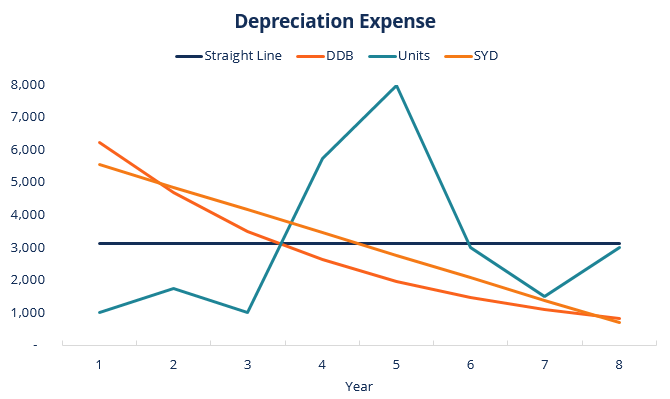

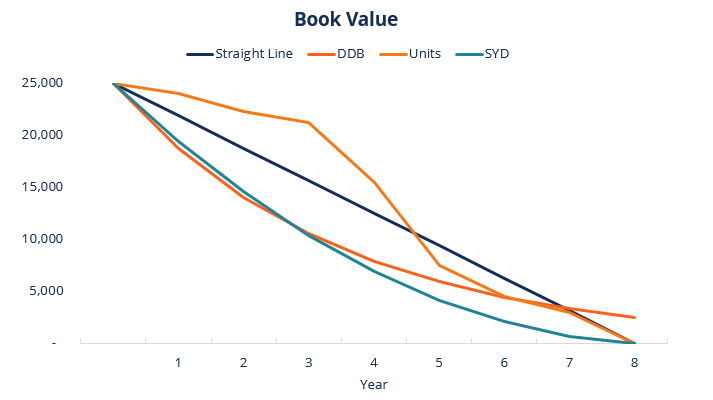

To find the. First things first the propertys basis represents the total acquisition costs incurred from buying the home. In the straight-line method of depreciation the value of the asset depreciates by an equal amount in each accounting period up to the end of its useful life when the asset is reduced to zero or its remaining salvage value.

The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. The original price of the machinery is 5000 the estimated useful life is 10 years the estimated residual value is 500 and the depreciation is calculated according to the straight-line method. Straight-line depreciation is the most simple and commonly used depreciation method.

There are precisely four methods of depreciating an asset named as follows. The unit used for the period must be the same as the unit used for the life. Multiply the assets fixed-percent depreciation by the purchase price of the asset to determine the amount of.

However you can choose to depreciate certain intangible property under the income forecast method discussed later. Straight line depreciation is the most commonly used and straightforward depreciation method Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. Sum of years digits.

Now its time to figure out which percentage table to use. ABCs depreciation expense is 2450. Eg years months etcTherefore the fittest depreciation method to apply for this kind of asset is the straight-line method.

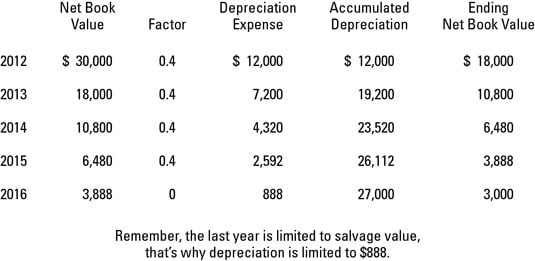

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation. For the book method of depreciation there are four main depreciation methods that are used. To calculate depreciation using the diminishing balance formula.

To determine the depreciation rate table to use for each asset refer to the MACRS Percentage Table Guide. For subsequent years multiply the value of the asset at the beginning of the year by the same percentage.

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods Principlesofaccounting Com

Double Declining Depreciation Accounting Financial Life Hacks Small Business Accounting

Depreciation Formula Calculate Depreciation Expense

Everything You Need To Know About Asset Depreciation Asset Infinity

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Methods Check Formula Factors Types India Dictionary

Ib Business Management Depreciation Youtube

Straight Line Depreciation Formula Guide To Calculate Depreciation

Property Plant Equipment Depreciation Methods Accounting Corner

Unit Of Production Depreciation Method Formula Examples

Depreciation Definition Types Of Its Methods With Impact On Net Income

Depreciation Methods 4 Types Of Depreciation You Must Know

What Is Straight Line Depreciation Method Pmp Exam Youtube

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

Comments

Post a Comment